Working Papers

1. Locational Rents and Deposit Franchise Value: Uncovering the Role of Distance in Deposit Pricing

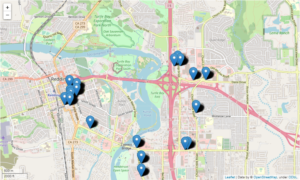

(Job Market Paper) Using novel foot traffic data from millions of cell-phone devices across the U.S., I study the extent to which the distance between a bank and its customers affects the pricing (interest rates) of its deposit products. Instrumenting the distance of the customers with regional broadband access status, I find substantial evidence for spatial price discrimination in the deposit market. The distance of the customers from a branch negatively affects the price of its deposit products; this price-distance relationship is stronger in highly concentrated market, consistent with the exercise of the market power. Cross-sectional analysis reveals that this negative effect of the distance is present for savings deposits, but not for transactional deposits. This effect is more pronounced for small banks and intensifies with the maturity period of the deposit products. Furthermore, paying lower rates for the deposits sourced from the distant customers translates into higher bank profitability. These results provide evidence on the presence of locational rents in the deposit markets that contribute to a bank’s deposit franchise value.

Using novel foot traffic data from millions of cell-phone devices across the U.S., I study the extent to which the distance between a bank and its customers affects the pricing (interest rates) of its deposit products. Instrumenting the distance of the customers with regional broadband access status, I find substantial evidence for spatial price discrimination in the deposit market. The distance of the customers from a branch negatively affects the price of its deposit products; this price-distance relationship is stronger in highly concentrated market, consistent with the exercise of the market power. Cross-sectional analysis reveals that this negative effect of the distance is present for savings deposits, but not for transactional deposits. This effect is more pronounced for small banks and intensifies with the maturity period of the deposit products. Furthermore, paying lower rates for the deposits sourced from the distant customers translates into higher bank profitability. These results provide evidence on the presence of locational rents in the deposit markets that contribute to a bank’s deposit franchise value.

Presentations: FDIC Bank Research Conference (2023 Scheduled), FMA Annual Conference (2023 Scheduled), Eastern Finance Association (EFA) Annual Conference (2023), Southwestern Finance Association (SWFA) Annual Conference (2023), World Finance & Banking Symposium (2022), Louisiana State University (LSU) Finance Seminar Series (2022), Louisiana State University (LSU) Economics Brown Bag Tea Seminars (2022)

2. Price Dispersion, Competition and Deposit Channel of Monetary Policy

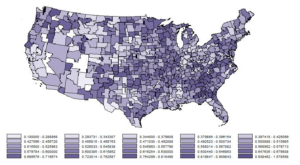

(With Rajesh P. Narayanan) We examine how the dispersion in deposit prices for banks operating in the same market varies with local market competition and with the stance of the monetary policy. By exploiting various regulatory reforms across different states in U.S. that allowed inter-state banking and branching, we find robust evidence that the local market’s bank concentration has a negative effect on the price dispersion of the deposit products. This effect of local market concentration on price dispersion is not monotonic and the price dispersion increases in the less concentrated market because of the branch entry as the entrant banks always offer higher prices over the incumbent banks. Importantly, we uncover a significant cyclical component in the deposit price dispersion which has implications for the operation of the deposit channel of monetary policy transmission. We find that the price dispersion diminishes during the period of loose monetary policy and increases during the tightening period. The results illustrate that deposit market power impedes the flow of monetary policy only in Fed tightening regimes, and that the effect of deposit market power is more benign in a loosening regime.

We examine how the dispersion in deposit prices for banks operating in the same market varies with local market competition and with the stance of the monetary policy. By exploiting various regulatory reforms across different states in U.S. that allowed inter-state banking and branching, we find robust evidence that the local market’s bank concentration has a negative effect on the price dispersion of the deposit products. This effect of local market concentration on price dispersion is not monotonic and the price dispersion increases in the less concentrated market because of the branch entry as the entrant banks always offer higher prices over the incumbent banks. Importantly, we uncover a significant cyclical component in the deposit price dispersion which has implications for the operation of the deposit channel of monetary policy transmission. We find that the price dispersion diminishes during the period of loose monetary policy and increases during the tightening period. The results illustrate that deposit market power impedes the flow of monetary policy only in Fed tightening regimes, and that the effect of deposit market power is more benign in a loosening regime.

Presentations: American Finance Association (AFA) Annual Meeting Ph.D. Poster Sessions (2022), World Finance & Banking Symposium (2021), Southwestern Finance Association (SWFA) Annual Conference (2021), British Accounting and Finance Association Doctoral Consortium (2021), Louisiana State University (LSU) Finance Seminar Series (2020)

3. Spillover Effect of Non-technological Strategic Alliances on Innovation

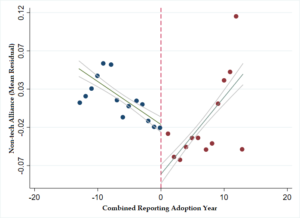

(With Miaomiao Yu) Though theory posits that strategic alliance partner firms can reap benefit through either exploration activities (knowledge acquisition) or exploitation activities (developing specialization), prior empirical works only find evidence for knowledge acquisition. So, we examine the spillover effect of non-technological strategic alliances, which constitutes majority of alliances, on innovation. Applying textual analysis to observe the geographical footprint of the firms, we calculate firms’ combined tax reporting status. By using this status as instrument variable, we find that non-tech alliances result in more innovation output as measured by number of patents and citations and the increase in innovation is due to increased specialization, as reflected by increased patents in firm’s existing technological areas and more self citations and backward citations. These findings imply that alliance formation can still be beneficial for the partner firms even in the absence of knowledge acquisition.

Though theory posits that strategic alliance partner firms can reap benefit through either exploration activities (knowledge acquisition) or exploitation activities (developing specialization), prior empirical works only find evidence for knowledge acquisition. So, we examine the spillover effect of non-technological strategic alliances, which constitutes majority of alliances, on innovation. Applying textual analysis to observe the geographical footprint of the firms, we calculate firms’ combined tax reporting status. By using this status as instrument variable, we find that non-tech alliances result in more innovation output as measured by number of patents and citations and the increase in innovation is due to increased specialization, as reflected by increased patents in firm’s existing technological areas and more self citations and backward citations. These findings imply that alliance formation can still be beneficial for the partner firms even in the absence of knowledge acquisition.

Presentations: Southwestern Finance Association (SWFA) Annual Conference (2022), American Finance Association (AFA) Annual Meeting Ph.D. Poster Sessions (2021), Southern Finance Association (SFA) Annual Conference (2020), 33rd Australasian Finance and Banking Conference (2020), Louisiana State University (LSU) Finance Seminar Series (2019)

Policy Paper

(For The Central Bank of Bangladesh)

A Study of the Perception and Behavior of the Depositors in Bangladesh

(With Md. Mohiuddin Siddique and Md. Shahid Ullah)

We investigate the factors that depositors consider, while opening a bank account. For answering this question, we collected response from a large number of different groups of depositors by gender, age, location, and occupation from all the banks of Bangladesh through a questionnaire. We find that, the dominant factors affecting choice of banks are interest rate, safety and distance as perceived by the depositors. Government owned banks have been reported as the safest (39%) followed by foreign banks (34%) among different bank groups. On the other hand, private commercial bank ranked first in terms of service quality as opined by 52% depositors. It is evident that the level of financial literacy of the depositors in Bangladesh is significantly low, and the depositors do not use the available information for selecting banks and making financial decisions. Large scale financial illiteracy thus inhibits the people from making informed and rational financial decision.

We investigate the factors that depositors consider, while opening a bank account. For answering this question, we collected response from a large number of different groups of depositors by gender, age, location, and occupation from all the banks of Bangladesh through a questionnaire. We find that, the dominant factors affecting choice of banks are interest rate, safety and distance as perceived by the depositors. Government owned banks have been reported as the safest (39%) followed by foreign banks (34%) among different bank groups. On the other hand, private commercial bank ranked first in terms of service quality as opined by 52% depositors. It is evident that the level of financial literacy of the depositors in Bangladesh is significantly low, and the depositors do not use the available information for selecting banks and making financial decisions. Large scale financial illiteracy thus inhibits the people from making informed and rational financial decision.

Contact

Phone: +1(806)773-0391

Email: nfaisa1@lsu.edu

nural@nfaisal.com